Dipping towards a beneficial 401k is going to be appealing.

- Current email address icon

- Twitter icon

- Myspace symbol

- Linkedin icon

- Flipboard symbol

A lot of the present workers won’t have pensions to-fall right back on within the old age. As we are into our personal for the funding all of our old-age, why are a lot of people sabotaging the upcoming security because of the borrowing from the bank from your 401k preparations?

Merely over one out of five, otherwise twenty-six%, of 401k players keeps a loan a great, considering a recent declaration from Aon Hewitt, an advantages contacting and you may government business. When you’re you to data failed to simply take the reasons why, yet another that conducted a year ago because of the TIAA-CREF located paying debt are the primary reason as to why anyone got aside financing, accompanied by spending money on an urgent situation expenses.

When you find yourself 401k individuals was borrowing out of by themselves, that isn’t an ordinary transfer of cash in one pouch so you can other, benefits state. An educated spin you could put-on its it will be the less many evils, told you Greg McBride, chief economic specialist getting Bankrate.

Anyway, most Us americans are not looking at 401k balance that they’ll manage so you’re able to browse. Based on Fidelity, the common 401k harmony is actually $91,3 hundred after 2014. One to contribution won’t actually security an average retiree’s health-care costs, centered on Fidelity’s individual prices. (A good 65-year-old pair retiring inside the 2014 commonly incur an average of $220,000 inside old age healthcare will cost you, Fidelity tactics.)

Weighing your options

Specific 94% out of mid and large-sized companies ensure it is funds with the efforts personnel are making to their 401k account, whenever you are 73% allow loans into the efforts brand new manager makes, predicated on Systems Watson, a specialist services corporation. Certain organizations let pros sign up for several loan during the a period of time.

The interior Funds Services fundamentally constraints a great participant’s plan funds to a maximum of $50,100000 otherwise half the fresh new participant’s vested balance, any type of was faster. Basically, money must exist in this five years, which have desire your fellow member is beneficial himself.

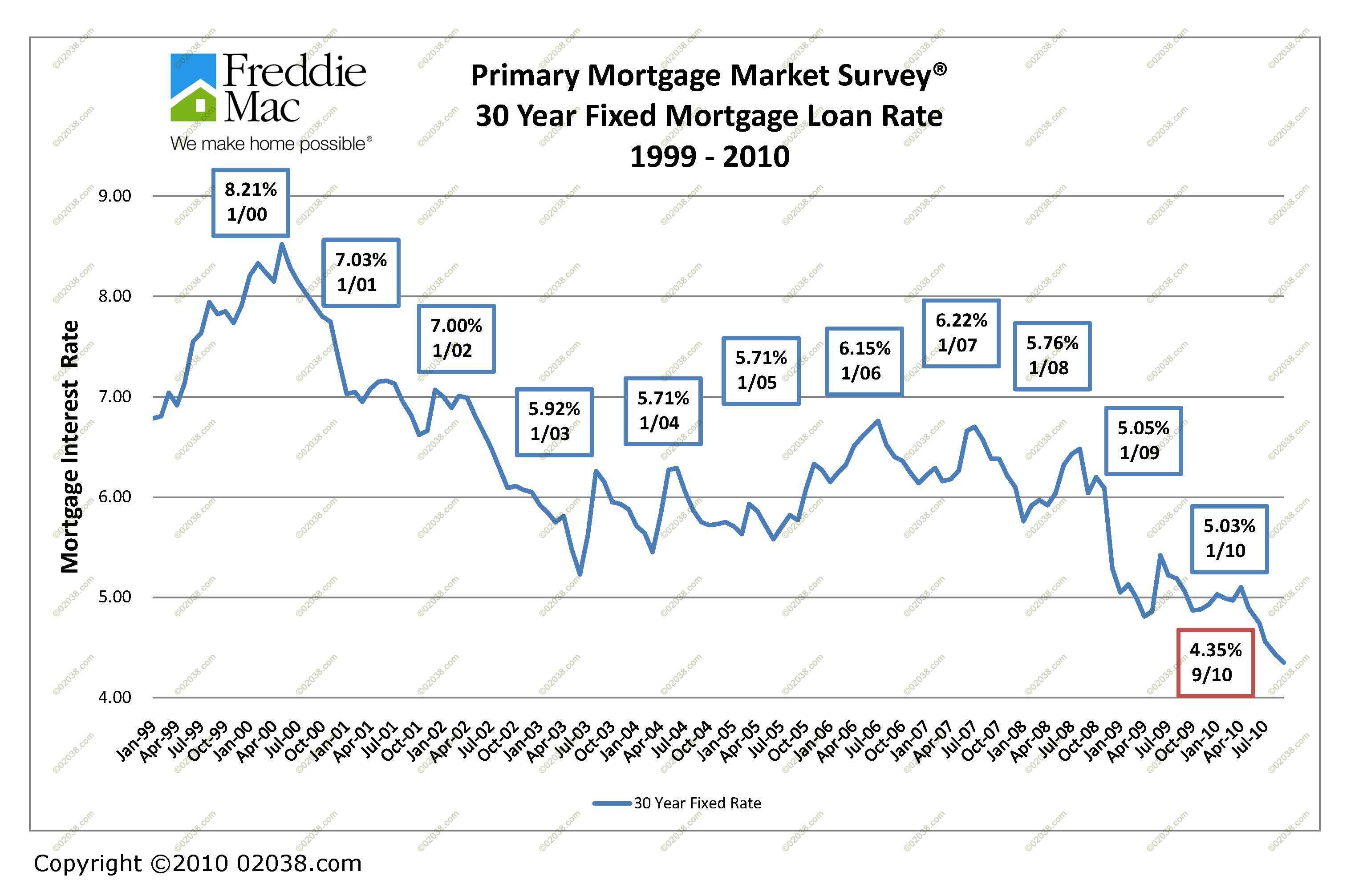

The program directors need certainly to put a reasonable interest you to definitely reflects the prevailing sector rate for similar money. Although Internal revenue service advice promote examples where in actuality the package trustees place mortgage loan highlighting sector-speed financing to your borrower’s borrowing from the bank reputation, masters state used of numerous arrangements usually do not go through the person’s creditworthiness and put a standard interest at the step one% or 2% along the finest price, a standard that’s currently from the step three.25%.

Those people considering an effective 401(k) loan should compare the fresh prices title loan Oklahoma they’re able to log in to other forms regarding funds, including a house guarantee credit line. For people with strong credit, that may be a much better option than simply borrowing from the bank regarding 401k, pros state. People with fico scores less than 680 are certain to get less exterior credit possibilities, and those that have ratings below 620 gets difficulty borrowing from the bank whatsoever, McBride told you.

Taking new problems

Borrowing off a good 401k plan exacts a massive opportunity costs. Consumers overlook people compound progress you to definitely its financial investments manage if you don’t have earned in the market. Of a lot plan professionals either prevent adding to the 401k or treat their share during its financing, so they really plus overlook the organization suits.

Except if the cash try paid down rapidly, the loan means a long-term drawback to help you later years thought, McBride said. (You will find some rare exceptions, he notes. Particularly, people who lent just before new inventory may have come-out in the future once they reduced their financing. But that is not a situation one anybody can anticipate or bundle doing.) Bankrate enjoys a hack you to computes how much money consumers is be prepared to beat regarding 401k fund, offered particular presumptions.