- Home improvement this is exactly a smart idea once the correct style of home improvements can increase the value of our home and on the other hand improve the degree of security you have.

- Debt consolidation if you have current costs elsewhere, you could discharge family collateral and make use of the money to blow those people debts from. Besides would you blend the money you owe together with her, but you can as well as capitalise on down interest levels away from home security loans and reduce your monthly payment. There are many types of debt consolidating that individuals mention towards the end regarding the book.

- Large instructions they may be regularly purchase larger-violation items like cars, expensive vacations or even college levels.

- Helping members of the family some individuals decide on these to availableness borrowing and give it in order to relatives to assist them get on the house or property ladder or for other setting. The bank away from mum and you will dad is actually real!

You will find barely people limits put-on what you can purchase the bucks for the. If you persuade the financial institution that you can spend the money for monthly payment and you have a great credit history, that’s it that really matters in it.

The pace to your house security loans

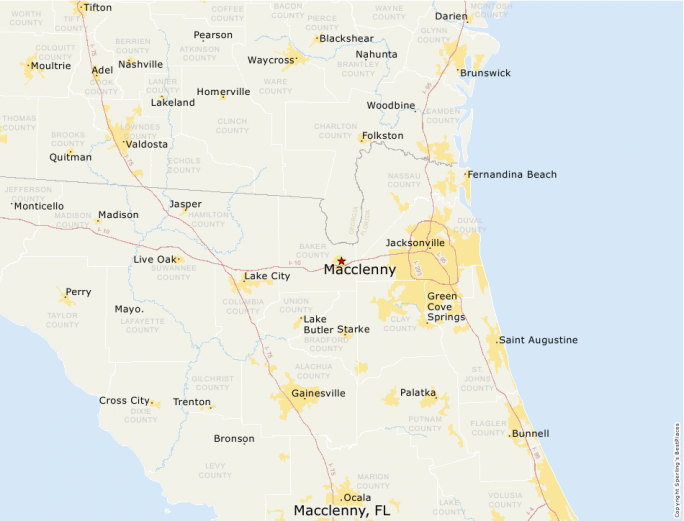

3k loan no credit check Cherry Creek CO

Among aspects of a property guarantee mortgage a large number of some body for example try its interest. Not just would be the interest rates throughout these funds less than really personal loans, they often come with fixed monthly notice. Which have a predetermined interest, it is possible to constantly know exactly how much your payment would be across the whole loan percentage period.

What’s property equity line of credit (HELOC)?

Property collateral personal line of credit (HELOC) is a lot like a house collateral financing with some key variations. Property guarantee credit line lets this new resident to gain access to borrowing from the bank in line with the security he has got in their possessions having their house as security, nevertheless the money is perhaps not given out into the a lump sum.

Alternatively, the credit are reached over the years during the homeowner’s discretion over a draw months, that will history decades. A good HELOC are a revolving credit line and you will work for the implies just like credit cards, opening an amount borrowed when called for. Only when the new draw period ends really does brand new resident begin making a payment to invest right back the loan count entirely, such as the dominant and you can attract.

The pace into a beneficial HELOC

Various other key difference between a house equity financing and you may household guarantee credit lines is the interest rate. While the former is sometimes fixed, a property collateral credit line typically has a varying price. You can shell out variable focus along side entire cost period, definition your payment per month can go up and you will off and you may not 100% sure of what possible are obligated to pay.

What’s the newest interest for the a house security mortgage?

The present day rates into the domestic security finance are different between lenders and will also be based on your loan in order to well worth proportion, individual profit and you may credit history. Although not, in accordance with the current market during writing, you can usually look for family security financing with an interest rates anywhere between 2% and you may 9.9%.

Rates are typically down in case your payment mortgage label is actually shortened. For example, if you wish to pay off over five years you are capable of getting a lesser rate than if you desired to pay back more than fifteen years.

The average interest on the house equity money

The common interest for a property equity mortgage during the time of writing and you can susceptible to change was anywhere between 5% and you will six%. In case your mortgage term are smaller, the attention drops in the entry level between these rates and you can vice versa.