They give you a quick and easy prequalification process as well as have promote quick refinancing quotes compliment of their site. But not, they luckily for us you should never promote its customer support solely from Internet.

Reali provides a concierge solution that may help you through the credit process of start to finish. The process is paperless and clear. Anybody who is even a small technical-smart tend to end up being each other common and you will comfortable this. Probably one of the most hard parts of home loan borrowing is perhaps all of your documentation and you will selecting missing files to give with the lender. The electronic system one Reali provides makes it clear about what you have to outline. Nonetheless they provide condition about what you will be missing, so that you will not have your investment otherwise recognition organized owed to help you a missing document or mode.

Financial off The united states

Being one of the primary banking companies globally indeed happens with a few positives that almost every other organizations can not afford, specially when you are looking at financial lending. Financial from America now offers numerous loan solutions and you can high-technology customer service.

Financial from America even offers many options from refinancing and purchase financing, and additionally changeable-rate mortgages having 5/step 1, 7/1, step one0/step 1, and you can fifteen-, 20- and you can 30-year fixed-price loans. In addition things bodies-covered financial factors including Experts Products (VA) and you may Federal Housing Administration (FHA) funds plus jumbo fund up to $5 mil.

Financial of The usa also has several apps which can be designed to create homeownership less expensive having first-some time and lower-income homeowners.

- Doing $seven,five-hundred for the financial borrowing from the bank having expenses including recording costs and you will title insurance coverage

- As much as $ten,000 to summarize costs and you can down payment recommendations

- One or two home loan products that have step three% minimum off costs: the fresh Freddie Mac Household You can mortgage in addition to Sensible Loan Provider mortgage

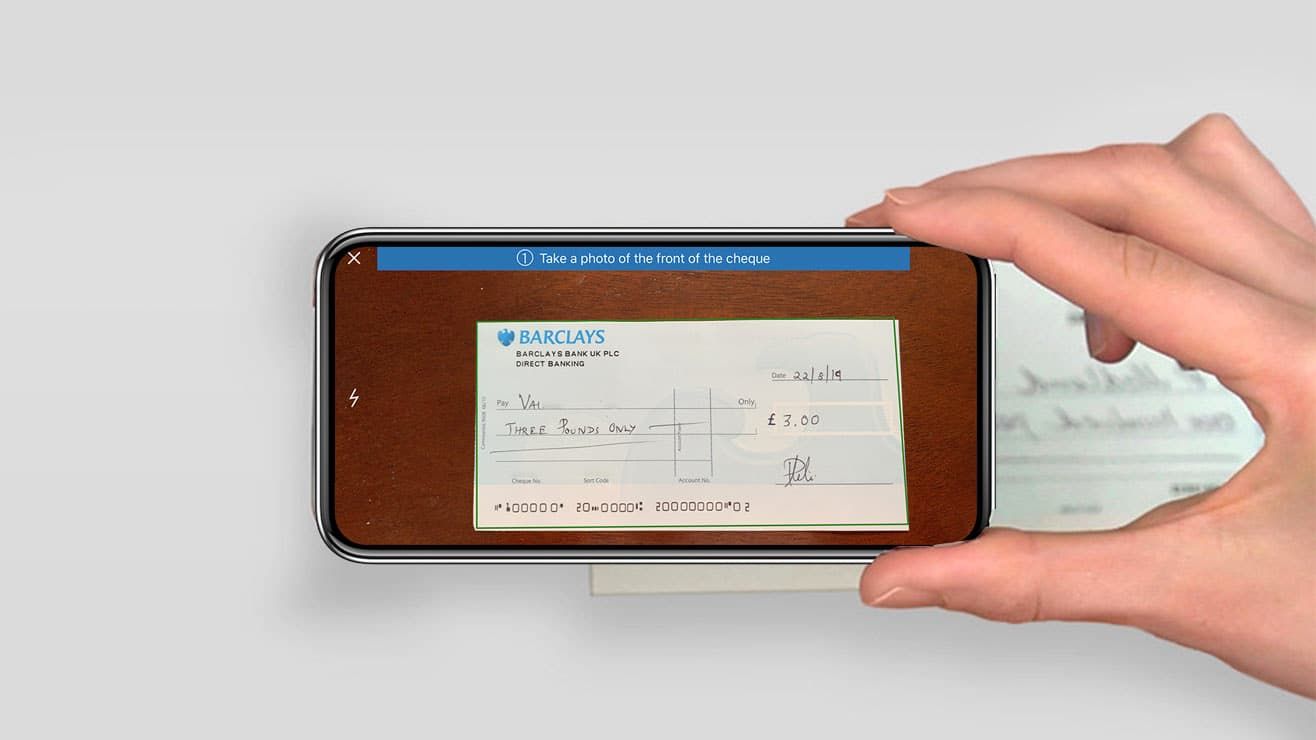

New electronic home loan sense out-of Financial loans Cordova away from America allows you to incorporate, get prequalified, and now have secure your own interest online making use of their mobile application or web site. You could potentially even be able to find preapproved for a passing fancy go out that you use. When you’re a lender of America customers already, your financial study and contact advice commonly automobile-populate toward electronic application, hence saving you day. You may want to incorporate inside the-person or higher the phone if that is something that you would rather. The house Loan Navigator webpage regarding Bank off The usa helps you stay plugged in about borrowing from the bank processes.

Protected Rates

You can make down repayments each month with an intention-only loan than simply with a normal, traditional mortgage. But discover that straight down payment, you do not make advances during the paying off the primary and you will building guarantee in the home. Due to this, interest-only fund usually commonly the ideal solution.

If you want to make an application for an appeal-merely financial, you should check away Guaranteed Rate. That it home loan bank provides excessively higher client satisfaction and offers interest-simply mortgages throughout 50 claims and Washington, D.C. Just be sure your conscious of new disadvantages of great interest-just funds before you apply for one.

Busey Lender

Busey Lender is a huge home loan company located in Saint-louis, Missouri. That it financial brings old-fashioned Midwest team pleasure employing honor-winning customer support ratings. it possess organizations from inside the Illinois, Missouri, Florida, and you will Indiana.

Busey may possibly not be the most significant financial around, however they bring numerous adjustable and fixed finance because really as the money from Virtual assistant and FHA home mortgage software. The annals of Busey financial dates back to help you 1868, it is therefore among the longest present lenders on this checklist.

PennyMac

Whether or not PennyMac isn’t related to the massive loan providers Federal national mortgage association and you will Freddie Mac computer, will still be a name you need to probably know if you are looking to possess an enthusiastic FHA financing which have the lowest down-payment. PennyMac is actually a direct financial, and therefore are mostly an internet-concentrated financial institution.