Refinancing your own mortgage is a significant step. From the handling a reliable bank, knowing what you may anticipate and achieving the latest records you need to come of energy, the procedure is going effortlessly.

What exactly is refinancing?

Refinancing are replacement your home loan with a brand new one to – which have brand new terminology, requirements, closing costs and perhaps another financial. Refinancing can help you reduce your monthly installments, lower your full payment count if not put your house guarantee in order to a great fool around with. Right here we are going to make it easier to see the advantages and disadvantages of refinancing to help you consider if refinancing is right for you.

Which are the benefits of refinancing?

There are lots of benefits to refinancing, together with cutting your monthly obligations, spending your house off fundamentally, lowering your interest, or getting cash out.

One benefit of refinancing is that you can provide some money in your finances by detatching the quantity you loans in Falkville are paying for the loan monthly. Otherwise, if you are not likely to remain in your residence to get more than simply a few more years, you might re-finance in the a reduced rate of interest having fun with a varying-rate financial (ARM) .

If you want to pay off your home eventually and lower the total amount of attract you’re investing in they, you could re-finance for a smaller mortgage title. In the event that interest levels features fell, you age as it’s now, and you will repay your property many years earlier. Performing this might save you several thousand dollars during the notice over the life of the borrowed funds.

Another reason to help you re-finance is always to take cash-out. It will help if you wish to purchase highest expenses, such as for instance home improvements otherwise educational costs . Bringing cash-out function making use of your residence’s guarantee to receive a one-date cash percentage during the refinancing. For cash-out, you’ll want to get that loan for more than your debt in your principal home loan balance. Just remember that , cash-out refinancing and additionally develops your current amount of home loan financial obligation.

Do i need to re-finance?

Look at your current mortgage and you will finances, plus monetary goals, in terms of a refinance. When you have a leading interest on your own latest financing or if you you want extra money, you might want to consider refinancing. You may want to should explore refinancing if you would like to lessen your monthly installments or slow down the total number you may be investing in your residence.

When can i refinance?

In the event the home loan prices is dropping or your house enjoys substantially increased in value, you may explore refinancing your home loan. Another great reason to re-finance is if your credit score keeps gone up rather. If you had a lesser credit history when you had the financial, your interest are most likely higher, and therefore large monthly installments. That have a top credit score, it is possible to qualify for that loan with a lowered interest rate minimizing monthly payments.

How to re-finance?

Ahead of moving on, ensure that your credit rating can be large that one may. Check your credit report and take care of people circumstances first. This may take some time, thus start off very early. The better your own get, the greater your chances of delivering a lower life expectancy interest and this could save you profit the long run.

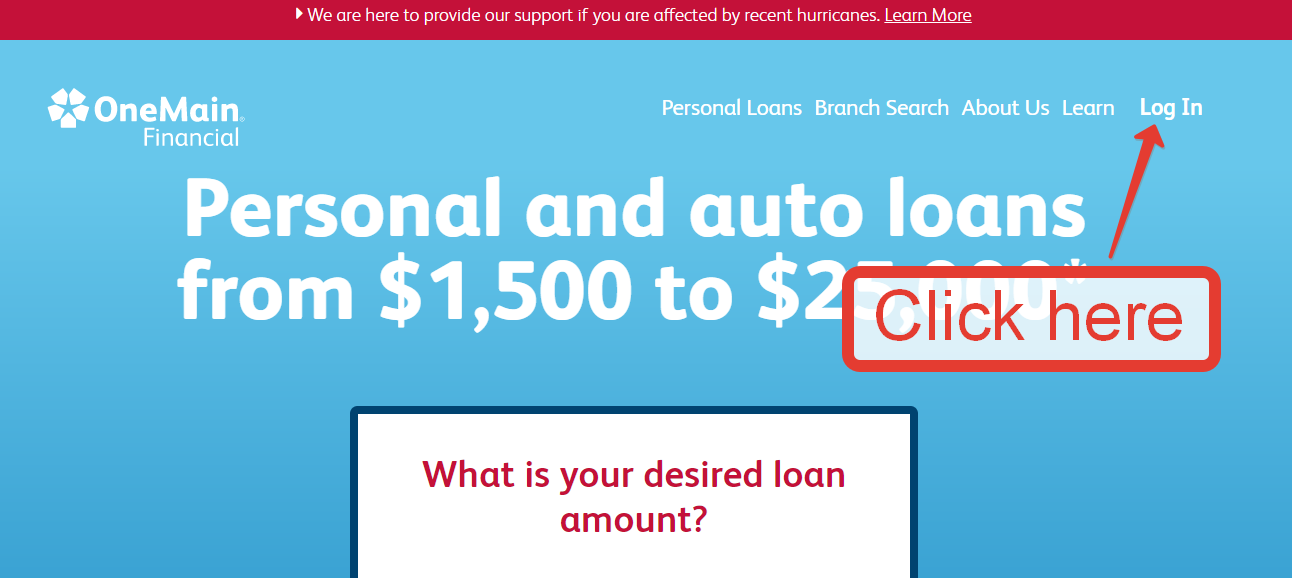

The next thing is to track down that loan with most useful conditions than simply your that. We could aid you to select the financing and you may cost you to definitely do the job.

Once you have discover suitable mortgage, it is time to pertain. Bring every records your Chase Household Credit Mentor demanded along with you after you apply. This helps build one thing go shorter. Your own advisor will in addition be able to give you an estimated closing time nowadays.