step one. Lower Rate of interest

One of the most popular reasons to refinance is always to safer a reduced interest rate. During the a 30-12 months financing, you could become using quite a bit of desire. Cutting your rate will save you tons of money more living of your own mortgage.

Caution: You’ll find up-front costs associated with refinancing. In order for your brand new interest coupons commonly exceed such costs over the years, a loan provider is going to do some elementary data to see if refinancing are going to be advisable for your requirements. Particular accept that you will want to conserve no less than step 1% on the rate of interest to have a refinance to make sense, but that is never the fact.

Your own discounts all hangs significantly towards the sized the mortgage youre refinancing. Including, an excellent ?% rate of interest cures to your a $400,000 refinance will save you extra money overall than simply a-1% rate of interest reduction on an effective $50,000 re-finance. Allow your financial make it easier to calculate the savings.

dos. Down Monthly installments

When you reduce your interest in the place of switching the length of the loan, you will be cutting your payment. Generally, you take aside yet another 31-year mortgage. Because your prominent is lower shortly after years of repaying your amazing mortgage, the monthly payments drop off.

Including, anyone with an effective $100,000 loan on 5% attract manage shell out regarding the $537 every month having three decades.

If you would like free up several of funds each month to spend with the anything, these refinancing may be the best choice for you.

step 3. Shorten Your loan Identity

One way to refinance your loan will be to trade-in your own 30-year financing to possess an effective 15-year home loan. 15-seasons fund usually have all the way down rates of interest. not, the fresh tradeoff is usually highest monthly installments.

You might like to create a great faux re-finance by creating more money towards the your own 29-year loan which means you pay it off in two the latest time. You would spend less initial since you won’t have to pay the latest label, insurance coverage, otherwise closure charges to help you re-finance. In addition it provides you with the flexibility to lower your own monthly premiums in the event your finances alterations in the future. This is an excellent choice if refinancing wouldn’t provide a decreased sufficient interest rate so you’re able to offset the upfront will cost you.

cuatro. Change your Mortgage Kind of

Money have both a changeable rate of interest or a fixed price. Some individuals will refinance to alter the kind of speed that they have. In the event that interest rates try reasonable, it would be best if you refinance the varying-speed mortgage in order to a predetermined-price mortgage so you’re able to protected one to lower rate of interest.

Invariably, rates have a tendency to increase once again in time, so securing a great fixed-price mortgage can save you a substantial amount of currency over time.

Downsides away from Refinancing

Refinancing is not usually ideal choice. For starters, it could be extremely big date-drinking because you go through the entire financing processes all-over once more.

You additionally have to pay most of the mortgage costs once more, together with title and you can mortgage tax. The greatest debts is actually investing closing costs once more.

If you re-finance the 29-seasons mortgage that have an alternate 31-seasons mortgage, a few that brand new interest rate is much less than your price. In case it is only a bit top, you might in reality end paying a great deal more when you look at the interest over time.

Your financial situation nowadays will make they essential you to reduce your payment. However, you will want to put a whole lot more towards the their dominating subsequently when the you could potentially to minimize their complete attention costs.

You really have a top-interest mortgage if you had in order to seek bankruptcy relief, recorded getting separation and divorce, otherwise had a monetary emergency. Loan providers promote most readily useful costs to those that have higher fico scores, so you may need certainly to re-finance since your credit history bounces back.

Refinancing ount away from equity in your home and you must borrow secured on they having family home improvements. You can acquire cash to pay for this new reputation and lower your interest at the same time.

Remember that refinancing constantly costs step three% – 6% of the newest loan’s principal equilibrium. It requires a few years to suit your desire savings to help you recover one to initially cost. If you believe you will offer your house in the future, you do not have enough time to recuperate those upfront will set you back. If so, it might not getting smart to re-finance.

All the Disease is special

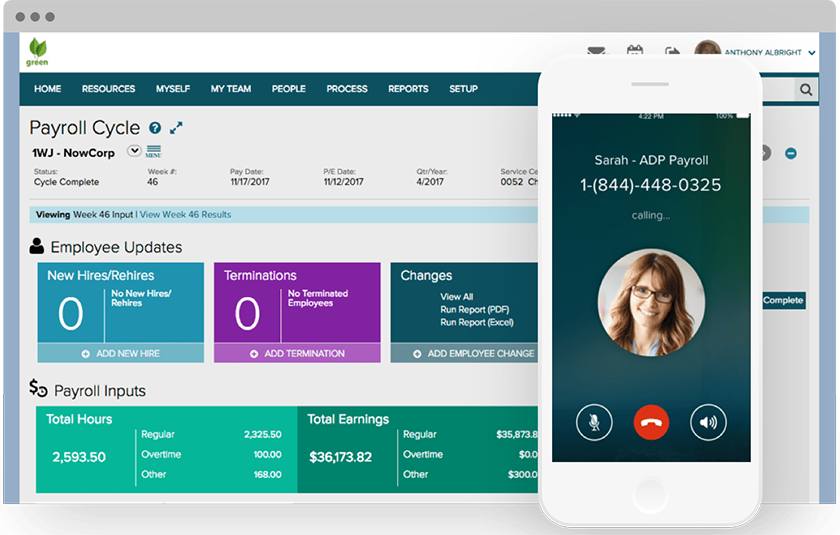

You’ll be able to initiate your own refinancing choice which have a straightforward financial calculator. When it appears to be refinancing will be smart to own you, get in touch https://paydayloancolorado.net/weston/ with our financing gurus. We could help you look at your re-finance needs and you may carry out the very first basic data instead of charging you people costs otherwise extract credit.

Our first data help see whether or not the potential deals is actually extreme adequate on how best to look at the re-finance process. Which have a reduced go out commitment at the start, together, we can choose which refinancing options, or no, is perfect for you.