Homeownership is a journey people dream about, in addition to solitary mothers. Whilst it may sound much harder to have an individual mommy, homeownership remains a sensible option. Sure, you can purchase property if you find yourself one mommy! These types of 7 some tips on exactly how unmarried mothers can buy a house, and additionally terminology of expertise out-of solitary moms who work for the actual property, are a good starting place.

Think Oneself On the New home

Make a sight panel or a list of everything wanted on your own new home. Begin by researching neighborhoods to own amenities, universities, walkability, transport, and anything else crucial. Browse the number on your own fantasy neighborhood immediately after which plan a great viewing out-of offered characteristics. They state whenever you can dream it, you can do it, therefore unlock oneself doing the homeownership dream by immersing oneself on it. This will also show you what is readily available and you will what the present day market looks like.

Dream. Package. Go. You will have barriers and you may demands in the act, but getting a homeowner is during your come to! Keep yourself well-informed and don’t think twice to inquire along the way. Kenise Batts , Agent, and you may Mommy

Discover Where you’re

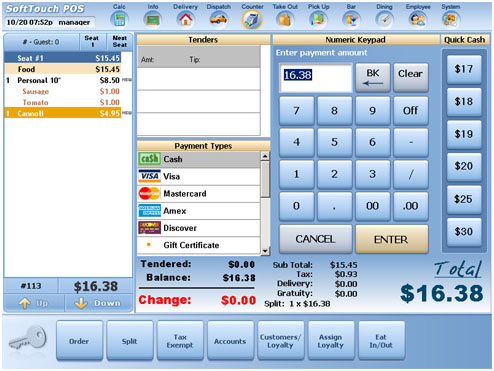

By the extract your credit reports, you will discover where you are for the credit rating. Using a home loan calculator, you should buy best away from exactly how much out of a great mortgage you can afford.

You can also really works in person that have a financial or borrowing from the bank union to learn simply how much out-of a loan at just what price you qualify and rating preapproved to possess home financing. Many people may prefer to start by a realtor who’ll plus collect this particular article. The option is actually yours, but make sure to feel safe for the kids you are dealing with and understand the terms of with them initial. HUD is served by tips that work with solitary mothers, and homes counselors that will consult with you 100% free otherwise an affordable commission.

Funds & Help save

Carry out a resources for the latest bills. Reduce low-essential will cost you and put that cash and you may a certain amount of the income on the a specific family savings for your coming house pick. It is essential to check out the costs of buying your home, for example equipment, furniture, and repair. Imagine allocating the the discounts having certain expenses which come immediately following your home get.

Do your research

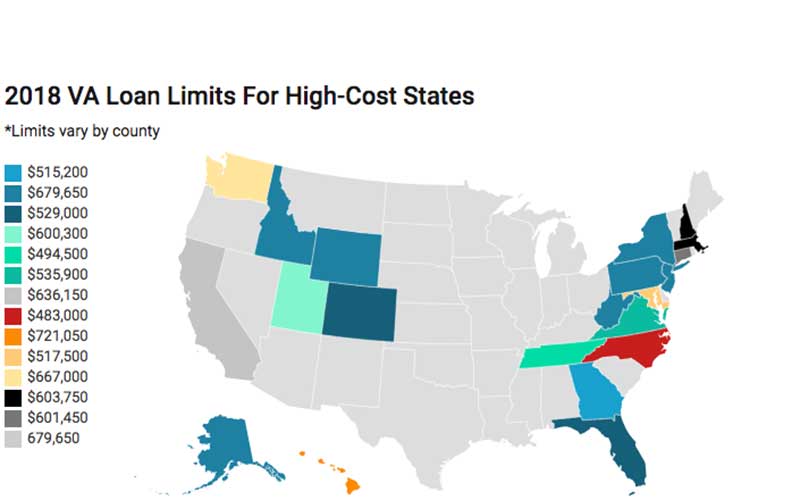

There’s no lack of things to enhance your hunt number once the one mother to invest in property. Consult with your local library getting following homeownership classes or any other information. Check out local and federal programs and gives that assist having home ownership, together with basic-time home buyers applications. Provides appear specifically for single moms, service users, and you may public servants. Solitary moms into the particular sphere s.

The ability of Negotiation

Whenever you are employing a real estate agent was designed to help you into processes, it is a good idea to get acquainted with the new ins and outs out of negotiations when purchasing a property. It experience may come into the helpful if it is time for you to negotiate last family can cost you and what, in the event that something, we want to be added ahead of closure. Knowing the market will additionally determine if you get a good rateparticularly important to have solitary moms and dads, and you will feamales in general, on account of predatory methods against feminine.

Settlement feel also are very important once you create your offer. Sellers will prevent the give. Their agent can help you navigate brand new transactions. Knowing what sensible surfaces is ahead will allow you to.

Different types of Possessions

Imagine good townhouse otherwise condo in the event that an individual-family home isnt on funds. Of many apps readily available for home buyers may also be used so you can get that it property method of. A good townhouse or condo , however, each one might be pick once the a homeowner. Anticipating, this type of assets can eventually take part in their wealth-building arrange for your loved ones. You can get just one-home and continue maintaining this 1 since the a bona-fide home asset.

A Fixer Top

An excellent fixer-upper is additionally a choice about a house in the event the better otherwise fantasy home is not available in your wanted area or is out of your financial allowance. A good fixer-top in that urban area ily towards the neighborhood, especially if in addition it has the facilities important for your.

Develop get loans prepaid debit card, these tips and you will conditions out of wisdom let you know just how single mom is also pick property and you can encourage one to initiate the homeownership journey.