Of the clicking „Come across Prices”, you’ll end up led to the ultimate father or mother organization, LendingTree. Considering the creditworthiness, you will be paired that have up to five other lenders.

Another home is a-one-device possessions which you want to reside in for at least an element of the season otherwise head to every day. Financing characteristics are generally ordered to own generating rental money as they are occupied by tenants for many the season. Discover significant differences in the costs and you may mortgage being qualified requirements anywhere between one minute home and you will a residential property which you would be to understand prior to purchasing various other home.

Table of material

- What is a second home?

- What exactly is an investment property?

- Just how mortgage loans disagree to possess 2nd family and you may money features

- Will it be incorrect so you can allege your investment possessions because the next house?

- Taxation benefits of 2nd house compared to. capital properties

What exactly is an additional family?

A second residence is property you order as well as your current the place to find live-in getting area of the seasons. Loan providers need proof the property is at minimum 50 miles out of your current residence are thought a second home. Types of second property become:

- Vacation residential property

- Pied-a-terres

- Houses employed for functions

Lenders envision a property a second house if it is a beneficial one-tool assets that isn’t susceptible to a great timeshare needs. The newest Irs describes another home given that a property your home is in for more than two weeks per year or ten% of your own total weeks your book they so you’re able to anyone else.

What is actually an investment property?

An investment property try a home bought to make leasing money otherwise flip and sell for income. Instead of 2nd belongings, a residential property can be more than simply that product: two- to four-tool money qualities enables you to earn money out-of numerous clients. A residential property may also be a commercial possessions.

Building an investment property portfolio enables you to build guarantee for the home with the rent built-up off tenants. It is a beneficial long-label wealth approach

How mortgage loans disagree for second home and you will money attributes

It’s generally minimal and easier to obtain approved to have the next real estate loan in the place of an investment property loan. Financing standards for sort of characteristics be strict than he is for first homes.

Mortgage prices

„Occupancy” can have a primary effect on the mortgage speed you might be given. Discover around three sort of occupancies regarding financial lending: top, 2nd family and you can money. Lenders constantly charges highest rates of interest getting 2nd belongings and you will capital characteristics, considering the chance one to individuals can also be walk off from the sort of services.

Residents usually focus on their number one belongings if the difficult financial moments strike, and lenders get mark up your interest rate because of the 0.50 to help you 0.875 fee situations higher than an initial residence. If you’re and work out a reduced down payment with the lowest credit get, the interest rate distinction would-be even higher.

Off costs

Lenders wanted increased down payment for funding attributes than next home to pay to the most likelihood of standard. An average minimal 2nd family down payment is 10%.

Lenders ily home investment property pick. Whenever you are buying a two- so you can five-device multifamily financing home, you will have to conserve to help you 25% into advance payment.

Homeowners that are prepared to reside in you to definitely tool away from an effective multi-family home for around 1 year could possibly get be eligible for a great mortgage supported by this new Federal Homes Management (FHA) that have only step three.5% down. An added bonus: The funds throughout the leased systems can be used to meet the requirements. New You.S. Agencies from Pros Affairs (VA) claims no down payment financing to have qualified armed forces individuals to acquire characteristics having doing eight devices for as long as the newest borrowers inhabit one of the gadgets.

Being qualified requirements

Loan providers normally lay a top pub to help you qualify for a moment house otherwise investment property financial than a primary house. Many lenders require a minimum credit score off 720 to have a beneficial 2nd home buy and you can 700 to possess a residential property while making the lower down deductible downpayment. They may actually need you to have sufficient cash to cover new repayments towards the family you may be to purchase for up to half a dozen months.

You’ll need to establish you have got sufficient earnings to pay one or two home payments getting an additional household or money spent. Normally, the fresh rental earnings to your an investment property can not be familiar with be considered unless of course the tax statements show you has actually assets management sense.

Local rental earnings

You are in a position to total up to 75% of your own expected local rental income so you’re able to counterbalance the mortgage repayment to the this new money spent you purchase. Yet not, lenders that offer this option might need specialized appraisal one assesses long term installment loans no credit check similar lease cost towards you.

The additional assessment demands produces an investment property appraisal more pricey than simply a routine appraisal. You can have to confirm you’ve managed local rental functions in the past for the lender to convey borrowing from the bank to have prospective lease income.

That exclusion is the FHA loan system. FHA assistance allow it to be FHA-acknowledged lenders to use forecast or real local rental money with the a good two- to four-unit possessions with the complete earnings, even although you haven’t any property manager feel. You should live in one of several tools no less than a dozen days to be eligible for this investment solution.

Will it be incorrect so you’re able to allege your investment property while the an additional house?

It can be appealing in order to allege you will be to get a house since the an additional family when you plan to rent it out so you can stop increased interest rate and you can down payment conditions. Yet not, lenders consider this „occupancy swindle” and it can lead to an FBI analysis and you can significant fines.

You can usually sign a keen „occupancy affidavit” at closing, that provides the financial institution the authority to foreclose on your own financing if they select your purposefully distorted the usage your house. Of several financial businesses have fun with large-technology electronic confirmation options to find proof of home loan con. Other people plan haphazard site check outs to confirm that is actually lifestyle home.

Flipping the second family into a residential property after closure

It is really not strange for someone to decide to transform an additional the place to find an investment property will ultimately. It is best to comprehend their home loan documents to ensure around are not any limits about how long your house should be used as the an extra home to prevent a study to own occupancy scam.

Don’t neglect to declaration rental income with the Internal revenue service when you document fees. If you opt to refinance, you are at the mercy of money spent assistance and you will interest levels into the mortgage. That means you will need much more security so you’re able to re-finance and certainly will probably pay a high rate than you did if the home is classified since another household.

Taxation advantages of next home vs. investment characteristics

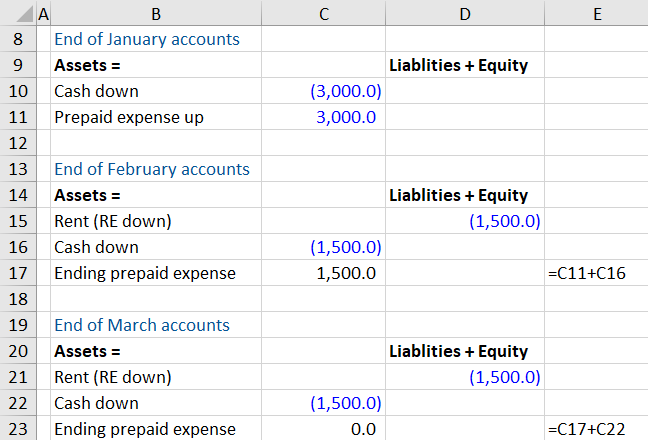

Brand new income tax advantages of one minute house are different off those with the an investment property. This new dining table lower than reveals extremely important differences: