Establishing and enforcing these controls helps prevent the misuse of funds and upholds the nonprofit’s accountability to donors and stakeholders. Internal controls are processes put in place to assure the integrity of financial reporting, safeguard assets, and facilitate adherence to laws and regulations. This precision ensures that readers of the financial statement can easily understand an organization’s obligations and the funds at its disposal. Here’s an example (page 4) of a complete statement of financial position or balance sheet of a nonprofit to show how yours can look. Your nonprofit must also include your balance sheet with a snapshot of your organization’s finances at the beginning and end of the year when filing annual taxes with Form 990.

Methods for Tracking and Reporting

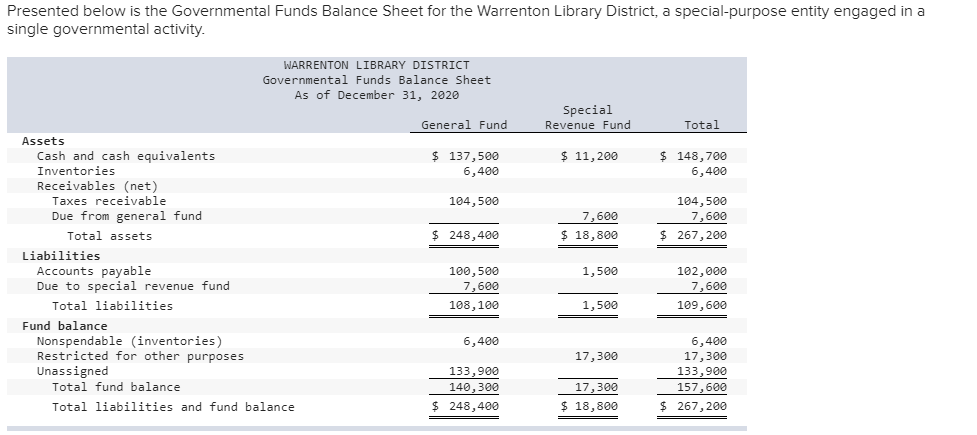

Above all, nonprofits must clearly report these assets separately from those without donor restrictions to provide a clear financial picture and maintain trust. It’s essential that each decision related to the use of funds adds to the organization’s operational efficiency, avoiding misallocation of resources. In the realm of nonprofit bookkeeping, effective financial management is underpinned by the strategic handling of both restricted and unrestricted funds. These strategies are pivotal for maintaining operational efficiency and ensuring financial transparency, allowing for informed decision-making and upholding the integrity of the organization. Fund accounting is crucial in nonprofits to categorize financial resources by specific restrictions. Each fund functions as a separate entity with its own financial statements, ensuring that spending aligns with donor restrictions.

What is Restricted Cash?

But even if that happens, those funds are not truly restricted in the legal sense. Real restricted funds are the result of a donor giving with specific strings attached as to what the donation may be used for. It may be the result of the nonprofit soliciting or fundraising for that purpose.

Best Donor Appreciation Gifts: The Art of Gratitude

- And this has led many to seek swift, effective, and stress-free ways of accounting for their restricted funds, including by using cutting-edge technology such as PreciseGrants.

- This article provides straightforward guidance on how to handle these funds effectively, ensuring compliance and transparency.

- The management of restricted funds is not just a matter of organizational policy but also of legal compliance.

- Recall that the quick ratio is calculated as (Cash and Cash Equivalents + Marketable Securities) / Current Liabilities.

- When that time period is over, the nonprofit might be required to give the leftover funds back to the funder.

- Nonprofits are required to produce financial statements that clearly distinguish between restricted and unrestricted funds.

Often, the larger the donation, the more likely that there will be donor-imposed restrictions. As a result, nonprofits that seek to attract gifts of this scale must be prepared to have robust accounting processes and procedures in place. To sum up, as nonprofits navigate the complexities of fund management, it is crucial to remember that the stewardship of restricted funds reflects the organization’s commitment to its donors and its mission. Most importantly, prioritizing restricted fund management builds a robust foundation for financial health, donor confidence, and long-term impact. To sum up, by adopting FastFund Nonprofit Accounting, Nonprofit X has transformed its approach to managing restricted funds.

This ensures clarity and aids in demonstrating compliance with the conditions set by donors. For example, if a contribution is for a specific project, the funds are temporarily restricted until used for that project. On the other hand, permanently restricted funds are typically endowments where only the income generated can be used, not the principal amount.

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. A company may set aside a certain amount of cash each quarter to make a payment on long-term debt.

All of the income from restricted funds, including multi-year grants, are expected to be recorded on the nonprofit’s books in the year an irrevocable commitment to the funding was received. Many grants have these policies in which you must either spend all of the funding received, or pay back the remainder. Designated donations for delayed programs after the fiscal year can cause issues. Prioritize your spending accordingly to avoid the reduction of these restricted funds. Nonprofit organizations leverage specialized technology to handle the intricacies of fund accounting, ensuring compliance and facilitating reporting. It is imperative for organizations to consistently review and update the status of their funds, ensuring that any changes in donor restrictions are accurately accounted for in a timely manner.

Propel Nonprofits is an intermediary organization and federally certified community development financial institution (CDFI). If donors don’t have confidence that their donation is really for the purpose advertised, you may handicap your campaign. The important thing to understand is that if you use a disclaimer or caveat, it needs to be very clear to the donor prior to the gift. Kristine Ensor is a freelance writer with over a decade of experience working with local and international nonprofits.

A company may be required by an insurance company to pledge a certain amount of cash as collateral against risk. When a company receives a bank loan, the bank may require that the company reserves (or maintains) a certain amount of cash that will be unavailable for spending. Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

Mismanagement or diversion of these funds can erode trust and damage the organization’s reputation. This reflects the organization’s integrity and commitment to its mission and donors. Navigating donor restrictions requires a blend of clear communication, meticulous record-keeping, and strategic planning. At the outset, it is crucial to establish a transparent dialogue with donors to fully understand their intentions and expectations.

Identifying when there is a restriction on a contribution and complying with that restriction is one of the most difficult aspects of nonprofit accounting. When the donation is received, revenue with donor restrictions must be recorded. Under current accounting standards, these funds are referred restricted funds on balance sheet to as “funds with donor restrictions.” The restrictions may be temporary or permanent. A temporarily restricted fund may specify that the money be used for a specific purpose within a particular timeframe. Donor-restricted funds introduce a level of complexity in nonprofit accounting.