- Collect your documents: Financing preapproval demands a collection regarding documents to verify the monetary info. Be prepared to promote W-2s, tax returns, spend stubs, proof fund for the down-payment, and your Public Shelter Matter.

- Find the correct lending company: It’s important to check around to possess an effective preapproval. You should focus on an established financial that provides glamorous rates.

- Fill out the newest documents: The loan bank will need a copy of financial files. Anticipate to address any queries you to definitely pop-up.

- Use your preapproval letter: Whenever household google search, make sure to glance at properties inside your recognized finances. Whenever you are ready to make an offer, allow the realtor be aware that you are preapproved.

Standards to have pre-recognition

- Proof income : The lender desires make certain you are able to keep up on month-to-month home loan repayments. Typically, it is in the way of a good W-dos, spend stubs or taxation statements.

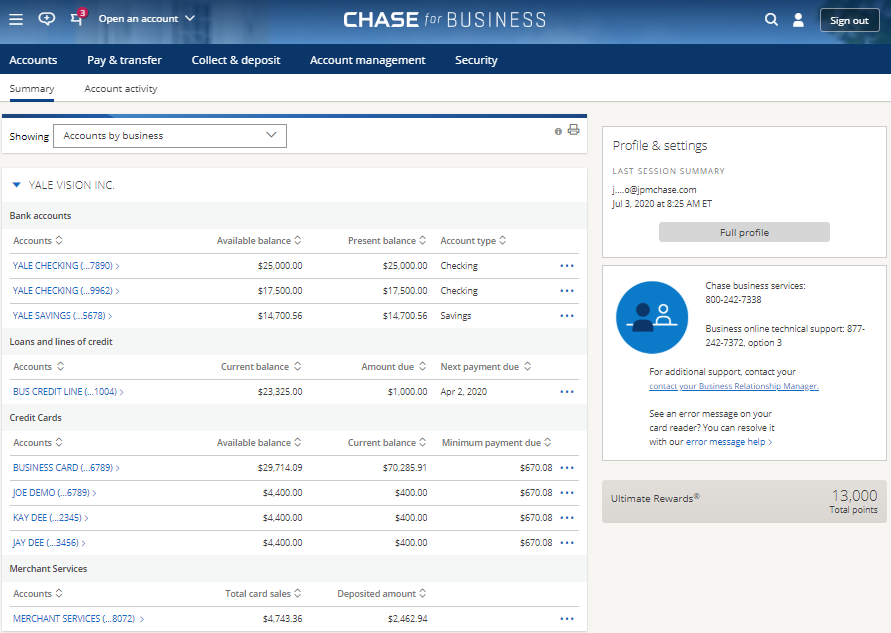

- Proof of possessions : At the very least, you’ll want to have enough money on give to cover downpayment and closing costs. Normally, you’ll want to provide financial statements to show the qualifications.

- A good credit score : You could potentially see a keen FHA financing which have a credit history while the low while the 580. However, a traditional mortgage means the absolute minimum credit rating out of 620. A lender commonly check your credit history in advance of bringing an effective preapproval.

- A job confirmation : A lender wants to make sure your money is reputable. While self-employed the financial institution may wish to find out about your organization.

- Other documents : Lenders will demand your own Societal Safety number, address and a lot more to confirm your data.

Home financing prequalification must not damage your own borrowing from the bank. With regards to the financial, they might request a self-reported score or work on a mellow credit score assessment. In any event, your credit score really should not be impacted.

To help you prequalify to possess a mortgage, you’ll want to answer a series of inquiries posed by the bank. Be prepared to provide all about your income, employment background, and credit history. If for example the bank enjoys what they see, you’re going to get a great prequalification letter.

Unlike relying on self-reported recommendations, the financial institution will demand paperwork of your credit rating, earnings, possessions, and a lot more

In preapproval techniques, loan providers think about your credit history, credit history, income, assets, and you will obligations-to-earnings proportion (DTI). The lending company will use this informative article to decide how much cash it is prepared to provide your to suit your brand new home get and you will guess just what financial pricing they may be able bring.

Bringing preapproved can help you dictate an appropriate https://paydayloancolorado.net/calhan/ budget for their a home search. At exactly the same time, vendors often offer liking so you’re able to customers having a preapproval in hand.

Beyond budgeting while domestic searching, a beneficial preapproval gives coming residents an authentic research the cost away from a house pick. You’ll discover more about the mortgage name options. Including, make sure your month-to-month income can conveniently help your own requested financial commission.

The best loan sorts of to own earliest-day home buyers hinges on their particular state. In some instances, government-supported financing apps could be the proper disperse.

The fresh new FHA mortgage is a good alternative with additional lenient credit requirements and you may the absolute minimum deposit regarding step three.5%. But as the a veteran otherwise armed forces associate, new Va loan might possibly be a better match an effective 0% downpayment needs.

In the long run, certain buyers which have sophisticated borrowing from the bank discover by far the most advantages of a conventional mortgage. New deposit is really as low just like the 3%. But you will deal with more strict credit criteria. Remember that an advance payment lower than 20% means you are going to need to pay mortgage insurance coverage. Yet not uncommon, it is critical to basis so it cost in the budget.