Aman Saxena

As the an NRI to shop for a new household individually inside India otherwise reily’s household can feel including fulfilling a lifestyle purpose. Find out about mortgage brokers to own NRIs as well as how it works during the India’s common banking companies.

First off, here are a few Indian finance companies that offer NRI-particular lenders. This list isnt thorough plus in zero variety of order:

- Axis Lender

- ICICI Financial

- County Bank out-of Asia

- HDFC Bank

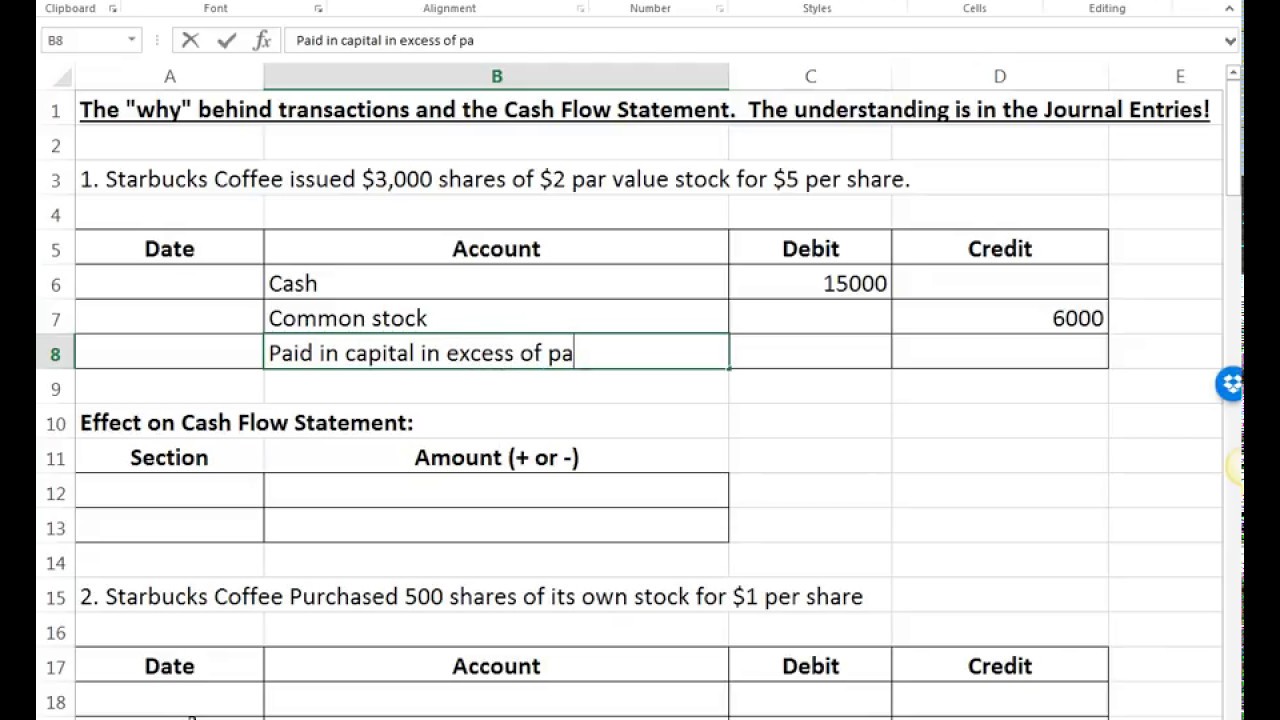

Also to observe all the finance companies comes even close to for every most other, is a handy desk evaluating per bank’s lenders for NRIs:

The way to select the right home loan having NRIs

Selecting the most appropriate home loan makes it possible to safe financing shorter, spend less, and gives simplicity whenever handling the loan. Below are a few factors to consider when trying to get an enthusiastic NRI financial that works for you:

Loan amount and you may EMI

Usually, the loan matter are relative to the price of the property you are searching to invest in, otherwise build prices for the newest home improvements. Its pulled because a percentage of your own pricing and can include 70-90% according to the count. You will need to supply the estimated will cost you and you will help data when submission your loan app.

Most banking companies provide a keen EMI substitute for create individuals and also make equal payments along side period of one’s financing. It is strongly recommended to play other problems into the mortgage count, rates, and you can tenure for the EMI hand calculators on the financial institution websites.

Eligibility

Earliest, guarantee the loan you’re going to possess is particularly for Low-Resident Indians so that your money and you may supporting data files is be considered.

2nd, be sure to meet the income standards to help you implement for a financial loan. Concurrently, view hence issues want a shared Indian Citizen co-candidate. Remember that a girlfriend which have obtained earnings will help while making the application stronger if you sign up for it together.

Cost

The first thing to view is your interest rate for the the borrowed funds. A diminished interest rate is the most suitable, however, be sure to look at the complete picture.

Banks keeps a lot more costs and you can charge which can seem sensible, regardless if he’s giving a low-interest rate. As well as, talk with your own financial associate towards the various ways to reduce your interest rate versus fees or period increasing, such as for instance including an excellent co-candidate.

Believe whenever you can rating a flexible installment plan or if there are charges having very early fees. Autonomy also have your ease that assist environment the brand new ups and you will lows of lives. But when you choose that have an apartment count you understand off first for the tenure of the financing, up coming you to balances can seem to be a also.

That have Smart you have made the genuine exhchange speed having that lower transfer payment, so no undetectable otherwise money sales fees right here. Wise is actually leading by over twelve mil anybody international, and also you get the money into your local savings account in Asia within seconds on the well-known pathways.

Insurance policies

Home insurance can be a supplementary factor to take on. Of a lot Indian finance companies render recommended home insurance visibility that have a keen NRI financial.

Axis Bank NRI mortgage

Axis Bank’s NRI lenders is designed for the needs and you may provide a soft strategy to with ease apply for financing online. But there is a month-to-month income dependence on applicants, according to your local area receive, and you may the absolute minimum works sense becomes necessary.?

ICICI Lender NRI mortgage

ICICI brings an NRI home loan which is often to own an effective new home, home improvement, or an area mortgage. Per has differing tenures and is accessible to salaried NRIs otherwise self-operating NRIs, for as long as the task experience and you may earnings criteria try fulfilled.?

Condition Financial regarding India NRI mortgage

SBI even offers home loans to help you NRIs for buying a property or investment property. SBI can have a few of the low costs out there and you can nevertheless they bring a marked down interest for women people.?

HDFC Lender NRI home loan

HDFC is actually a famous lender to have NRIs while offering a property financing for reily occupied home. You will find versatile payment solutions and you may automated EMI money readily available, however, you’ll find costs getting early payment.?

Lender away from Baroda NRI home loan

Financial off Baroda even offers many mortgage brokers getting NRIs to pick from possesses a selling point of a no cost borrowing card having a year by firmly taking a loan off ?dos lakhs or even more. Bank out-of Baroda also does not require a co-applicant and you can implement on the web.?

Federal Lender NRI home loan

Government Bank also offers an NRI home loan that may be getting building a special home, to buy residential property, otherwise sprucing up a preexisting house. Government Loans from banks can cover-up so you can 85% of costs and you may a straightforward EMI produces money convenient.?

Financial away from India NRI financial

Bank of Asia also offers the mortgage services in order to NRIs having renovating otherwise constructing property. That have a faltering on the web exposure, it is advisable to head to https://paydayloancolorado.net/holly-hills/ a financial off Asia branch to ensure that you be considered to own home financing.?

PNB NRI financial

PNB also offers home loans for remodeling or the brand new design from an excellent house. The program techniques may need applying in person and include your degree official certification, but PNB lender possesses mortgage extensions to a current PNB home loan.?

- Axis lender

It book is offered for general advice motives simply in fact it is maybe not meant to shelter every facet of the fresh topics with which it marketing. This isn’t designed to add up to suggestions about that you is always to count. You must receive elite group or specialist pointers prior to taking, otherwise refraining regarding, any action in line with the content inside publication. The information within publication doesn’t form judge, tax or any other expert advice off TransferWise Minimal otherwise its associates. Early in the day abilities dont be certain that a similar outcome. I build no representations, warranties otherwise guarantees, whether express otherwise implied, your blogs about guide was exact, done otherwise state-of-the-art.