It is really not usually just the right time and energy to buy a property that is ok! Both immediately following reviewing the money you owe and wants, it’s a good idea to carry on your existing path.

Because the an initial time Homebuyer, you might have to present your credit more before buying your own earliest family. Building your credit requires specific functions, however, taking right out an loans Heflin auto loan otherwise having fun with a credit card on a regular basis and you can and make regular payments may help make your credit.

Long lasting goes on the path to homeownership, Founders will be here to answer your questions every step of one’s means. Our Home loan Officers would be sincere to you therefore is believe he or she is helping you along with the best appeal for the coming. To talk to an interest rate Administrator call step 1-800-845-1614.

Click the link to use all of our mortgage calculators and see just how far family you really can afford. As a general rule from flash, the price of your property really should not be greater than three times the annual family earnings.

Choosing how many bed rooms, the dimensions of off an outside and exactly how much area you want are a few things to consider prior to starting your property research.

There are many version of land a house inside the an area, a beneficial townhome from inside the an information, a flat inside an establishing, and more. Knowing the sorts of home we need to pick is very important to understand the most costs you’ll be able to happen. Belongings for the communities may have Residents Connection fees, and this can be a pricey expenses.

The First-time Homebuyer System does not include mobile residential property otherwise strengthening a bespoke home. I do have circumstances readily available for these types of homes and you will an interest rate Administrator might possibly be happy so you’re able to come across the proper unit to you. To speak with a mortgage loan Manager name step 1-800-845-1614.

As the a homeowner, you are guilty of every aspect of this house your house alone, the newest lawn otherwise homes the house is found on, and all sorts of the things that improve home setting. Including appliances, hvac gadgets and a lot more. It’s always best if you have more money inside offers and you can for sale in situation one of these costly items must be repaired otherwise replaced.

Economic benefits of home ownership.

You may be capable subtract mortgage appeal and you may possessions taxes getting income tax gurus. Consult your income tax mentor away from income tax deductibility.

Saving to own a deposit for buying a house may take age, but remember the high their downpayment try, new faster you will need to funds. Creators Very first time Homebuyer System simply requires the applicant possess an effective at least $step one, throughout the deal. That it minimum includes settlement costs, prepaids or an advance payment.

Whenever you are protecting your home mortgage, it’s a good idea to blow a great expense and never just take away people the brand new debt.

Here are some the Mortgage options.

- 100% Financing

- No PMI (Personal Mortgage Insurance policies)

- Zero origination fee otherwise things

- To $three hundred,100000 limit amount borrowed

- Prices as low as six.76% APR*

- With a varying price, mortgage payments are usually straight down early in the mortgage title, but may increase from the given times of longevity of new financing.

- Interest rate can change regarding lifetime of the borrowed funds and you can can go up or down, considering economy requirements.

What is actually second?

Even though you get your Home loan on the internet, a mortgage Officer commonly get in touch with your about your specifics of your request also to remark your credit report. Our instructed Real estate loan Officers will be able to review your own disease and make sure you’re going to get best Home loan to have the money you owe.

To keep the application techniques as simple that one can, ensure you sign and you can get back people expected records into the Home mortgage Administrator rapidly.

Our very own Mortgage Officials continues to talk to you most of the action of one’s method including when appraisals have to be arranged, if the closing meeting could well be and you may any procedures you want when planning on taking to go into home to your goals.

Once closing.

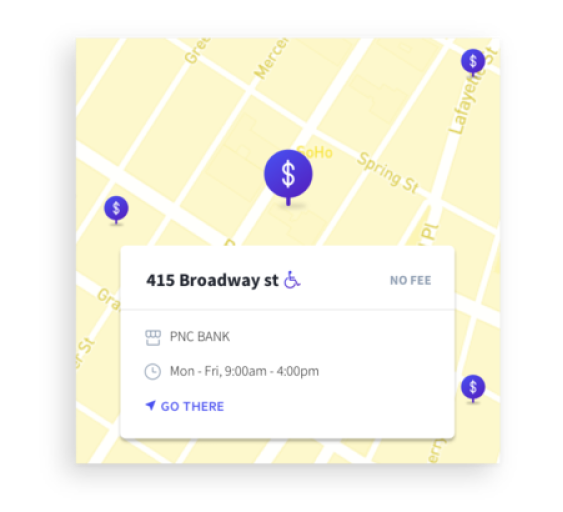

Dealing with their Founders Mortgage is not difficult! You could conveniently availability and you can pay the Mortgage in the Founders On line otherwise when you go to an office near you. When you have questions relating to their Home loan, our Mortgage Officers will always offered to assist you.

Details

- Variable Speed Loan options which have initially price intact having basic eight many years

- Up on earliest eight many years of the loan, the interest rate will to change annually to dos% each variations and you can 6% along side longevity of the mortgage

Costs and you may terms are very different depending on the particular financing, financing in order to well worth ratio, credit investigations and you can underwriting standards. Apr are subject to boost or disappear. Pay just 4.27% Apr on your first mortgage mortgage which have 360 monthly obligations away from $ each $sixty, borrowed. The new percentage can increase to $ regarding the 10th 12 months of your own loan. Up to one hundred% LTV and no origination percentage. Flood, assets insurance, and fees, in the event that relevant, aren’t calculated in the payment analogy. Actual percentage responsibility is better in the event the an escrow membership is actually called for. All loan applications, prices, terms and conditions, and requirements try at the mercy of confirmation of information, your credit report, the location and type from property or other things since the computed of the Credit Union and may change any moment instead of notice.

1 Provide for no origination payment is available for particular financial products to have first time homebuyers. dos Creators Insurance coverage Functions provided thanks to Founders Economic Class, LLC, working since the Creators Insurance rates Characteristics. Insurance policies items perhaps not underwritten because of the Founders Financial Group, LLC, or any connected business. Not NCUA Covered – No Borrowing from the bank Connection Verify – May Clean out Well worth – Perhaps not Places – Not Insured by people Authorities Service.