New Federal Homes Government (FHA) provides house loans getting standard, prefabricated, and you will mobile land to certified residents and you will eligible features. The best way of capital an excellent prefabricated house is because of the a consistent FHA financial. Generally, both house and prefabricated house try received along with her. The mark resident(s) need to meet up with the very first recognition conditions.

The brand new FHA financial program continues to be among best an effective way to funds a house pick. The down-payment is step three.5 per cent and may also feel „donated” of americash loans Sandy Hook the a qualifying donor (we.age. moms and dads, sisters, and below certain standards, a friend). Owner can get protection specific otherwise every client’s closing costs. Read more regarding FHA home-financing

FHA were created, modular and you may cellular house-mortgage direction

As a result of the FHA’s verify of FHA prefabricated mortgage brokers, specific requirements need to be came across. Included in this will be the pursuing the, but not simply for:

- The newest house need started founded after Summer 15, 1976.

- eight hundred sq ft is the minimal dimensions which are financed.

- For each and every goods have to have new red-colored HUD label.

- Our home should be permanently connected with a charity who’s come authorized by the FHA.

- The fresh prefabricated house’s place have to be desired.

- Our house need conform to the Design Are produced House Installment Conditions.

- The newest household must be the owner’s dominant quarters.

FHA Term We loan

The new Government Homes Administration’s identity step 1 credit program produces the acquisition otherwise refinancing from prefabricated land. A title We financing can help pick otherwise re-finance an effective prefabricated family, establish possessions on what to create one, otherwise a combination of the 2. The fresh borrower’s dominant home ought to be the dwelling.

Consumers are not necessary to own or very own the property towards the hence the prefabricated home is based in purchase so you can be eligible for Identity I insured funds. As an alternative, individuals may book much, such as a web site lot in a created home neighborhood otherwise mobile domestic park.

If land/package is leased, HUD necessitates the lessor to offer an excellent three-year very first lease identity on the are created resident. On top of that, the book need stipulate that when the new lease is going to be terminated, the fresh homeowner must be given no less than 180 days’ authored notice. This type of rent stipulations are created to protect citizens if your lessors sell the latest land or close the playground.

twenty years having a mobile mortgage otherwise a produced family and you may package financing in a single piece fifteen years to possess a prefabricated domestic homes mortgage A twenty-five-12 months financing getting a multi-part prefabricated family and you may homes Supply: Agencies of Construction and you can Funding

The latest USDA and are created property

The us Agencies away from Agriculture (USDA) often let the use of a made mortgage loan to finance the acquisition out-of a qualified the brand new unit, distribution and you will settings costs, while the acquisition of a qualified site (otherwise currently owned by the candidate).

Potential homeowners need to fulfill normal degree standards, including earnings, work duration, borrowing from the bank, monthly income, and you can monthly debt obligations. Read more in the USDA qualification

If the tool and you may place is actually shielded from the a genuine house financial or deed out of faith, financing to pay for the next can be guaranteed.

Work on a site you to complies that have county and you may state requirements. Acquisition of a different sort of eligible unit, transportation and you may configurations charges, while the purchase of a different eligible website if the applicant cannot currently own you to. Are formulated gadgets must be lower than a year old, unoccupied, and you can completely consisted of in site.

The purchase contract have to be performed in one seasons of are produced date of your own product, due to the fact found towards the plat. An effective device which is qualified for brand new SFHGLP be certain that have to satisfy another standards:

In order to be considered, the brand new tool need the very least space on the floor of 400 sq ft. The brand new prefabricated home need to follow Government Are designed Household Construction and you may Coverage Criteria (FMHCSS).

These devices should be permanently installed on a foundation you to definitely complies that have latest FHA laws in the course of qualification. HUD-4930.3G, „Are manufactured Housing Permanent Basis Guide,” has started to become available on the internet during the

The origin framework are accepted meet up with the needs of HUD Guide 4930.step three, „Permanent Fundamentals Publication having Were created Houses (PFGMH).”

The foundation certification should be approved by the a licensed elite group professional or registered designer who is registered or entered in the condition the spot where the are made home is situated and certainly will approve that new are available household complies having newest PFGMH standards.

The latest qualification must be webpages-particular you need to include this new signature, close, and/otherwise state permit/qualification quantity of this new designers or inserted architects. Read more

Questions and you can Answers regarding Are produced Home loans

Q. Ought i discovered a cellular financial that have terrible credit? A beneficial. This new Federal Homes Government (FHA) often money a mobile home in the event your structure complies that have FHA requisite (find a lot more than) additionally the applicant(s) meets FHA’s practical credit and you may earnings standards. The latest FHA need individuals having fico scores as low as 500 (up to 579), however, requires an effective 10% advance payment. New limited down-payment on property having a credit history of 580 otherwise above are 3.5 %.

Q. How to sign up for an FHA-insured cellular financial? A. Just sign up so you’re able to an FHA-recognized financial.

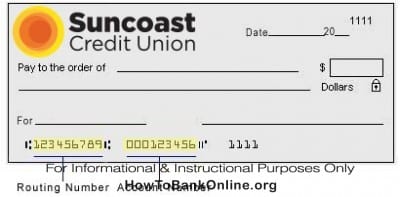

Q. The length of time can it grab getting a mobile mortgage to help you become approved? A beneficial. Obtaining pre-acceptance or mortgage recognition usually takes as low as one otherwise two days, offering the applicant has the requisite documents (we.age. shell out stubs, W-dos forms, bank statements, etc.).

Q. Simply how much down payment becomes necessary toward a cellular domestic? A great. As previously indicated, a good 3.5 per cent deposit is necessary for individuals having a credit score much better than 580.

Q. Can it be difficult to find financing to have a mobile household? Good. Loan acceptance is fairly effortless when compared to other types of mortgage loans.

Q. Try prefabricated houses qualified to receive FHA financing? An effective. Probably. Many providers are aware of the FHA’s building criteria to make all work to stick to her or him.

The latest calculators and details about this site are given for you given that a home-let tool to own educational purposes merely. We cannot plus don’t guarantee the appropriateness otherwise correctness of your pointers on your own specific disease. I firmly advise you to score personal the advice of skilled positives.