2nd, you really need to identify any accredited expenses associated with this new HELOC. This new TCJA constraints the latest deduction getting appeal on the domestic security funds and you may HELOCs to costs associated with the purchase, build or improve out-of a qualified family. Regarding renovations and you may solutions, for example replacement this new roof, establishing a unique Cooling and heating system, refinishing hardwood floors, surroundings, masonry functions and a lot more.

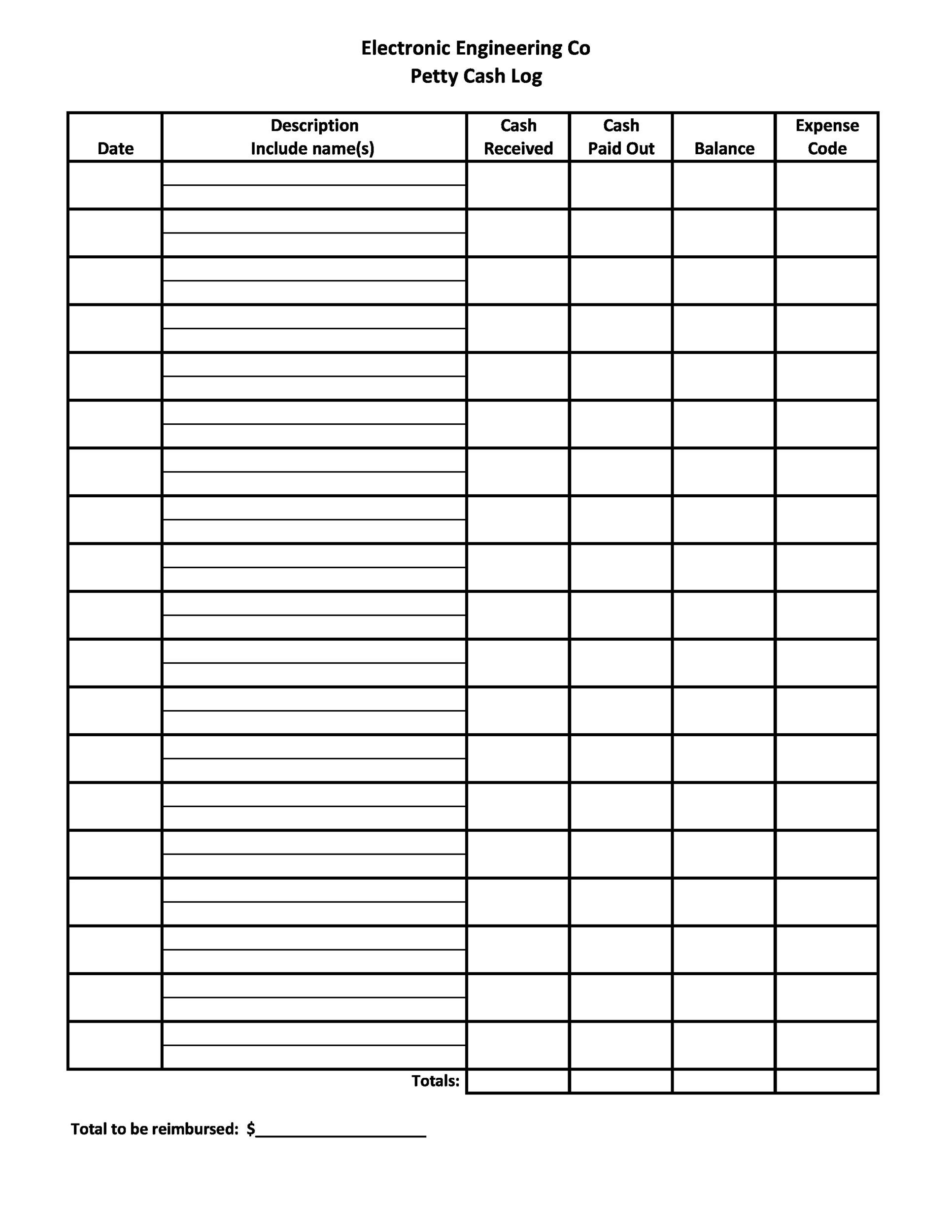

Each one of these circumstances is sold with a variety of will set you back, together with work and you will material. You will need to song this type of expenses carefully and keep reveal listing of all of the costs associated with the HELOC-financed methods. It indicates recording what kind of cash you allocated to each pastime as well as remaining any invoices and you will statements. Financial statements will also help provide a detailed report trail out-of all these transactions in case there are a keen Internal https://paydayloancolorado.net/gardner/ revenue service audit.

After you have gained the necessary papers of the accredited HELOC-financed expenditures and you can points, it is time to determine the total amount of notice you have reduced in your loan. The month-to-month HELOC comments can give reveal report about the fresh complete notice paid off more than a given several months. For example, for people who grabbed aside a great HELOC from inside the and reduced interest into they for the remainder of the year, your report will teach the level of interest taken care of the fresh entire season. The lender must deliver a type 1098 yearly one to contours the degree of mortgage notice you purchased income tax aim.

4. Establish the complete allowable focus

Once you’ve computed their overall financial attract paid, it is vital to guarantee the full deduction count. Just remember that , HELOC appeal is tax-deductible to the basic $750,000 out of overall qualifying indebtedness ($375,000 if the partnered filing ounts beyond the first $750,000 isnt income tax-allowable. You’ll need to seem sensible the quantity of HELOC attract taken care of the new taxation season, deduct people non-allowable numbers and you can go into the overall on your taxation return.

5. While in question, consult a taxation top-notch

Like with most other significant tax-relevant matters, it is advisable to talk to an experienced tax professional when the you might be not knowing about how to properly declaration their HELOC taxation make-out of. A professional can assist ensure that you may be truthfully revealing the HELOC attention tax deduction on Internal revenue service, and provide solid advice towards any other it is possible to taxation-rescuing procedures that may connect with your specific state.

Most other taxation implications out of HELOCs

In addition to the HELOC taxation implications listed above, there are numerous taxation-associated activities really worth clarifying. In the first place, HELOCs commonly taxed since typical income, because they represent money loaned rather than received. 2nd, particular jurisdictions (several says and shorter municipalities) impose a home loan tape taxation toward home equity funds and you may HELOCs, which is normally a share of your own complete loan amount. Finally, subtracting interest payments to have HELOCs will demand you to definitely get an enthusiastic itemized deduction as opposed to the important deduction. In some cases, you’ll be able to owe faster inside taxes by using the fundamental deduction.

Does HELOC apply at assets fees?

In most jurisdictions, only the appraised property value your house while the appropriate local income tax rates dictate your home goverment tax bill. Therefore, the degree of HELOC you take away won’t apply at your house fees. But not, if you utilize proceeds from the fresh HELOC to invest in specific home advancements or updates you to make appraised worth of the home going right up, then your possessions taxation might increase. Eg, when you use an excellent HELOC to include a different pond or make most other significant developments towards possessions, your regional assessor could take which into account when quoting the fresh value of your property getting income tax motives.