Their credit card can make payments smooth and you may convenient, it might destroy your odds of bringing an aggressive financial if you aren’t mindful.

While it is correct that that have credit cards can help generate your credit rating, it may also works up against you when it is for you personally to pertain for home financing.

Why does their bank card apply to your credit score?

Just as employers may use the college or university GPA to guage their more than likely efficiency of working, lenders make use of credit rating to greatly help see whether you’re going to be capable pay-off a loan.

If you are searching so you’re able to borrow, loan providers have a tendency to consider carefully your credit score because indicative out of risk – the lower your credit score try, the fresh new riskier you look.

But it’s the manner in which you make use of bank card one influences the complete credit history. When you yourself have a credit card and you will spend the expense on the big date – or, if at all possible, clear your debt totally each month – it is experienced a indication you’re going to be likewise diligent for making mortgage repayments.

But not, otherwise pay their bills on time otherwise regularly skip money, your credit rating will most likely has actually suffered.

Is it possible you score a mortgage when you yourself have charge loan place in Pierce card obligations?

Why don’t we be obvious, personal credit card debt usually impression your house loan application. But it won’t always signal your from getting property mortgage.

Certain lenders is prepared to lend to you when they are able to see you will be making repayments punctually otherwise, better yet, trying to lower your credit debt.

However some loan providers can get refute you outright, others might let you use from their store but in the a higher interest rate.

An experienced large financial company would be invaluable from inside the guiding you with the loan providers whoever policies are even more sympathetic on people with borrowing card obligations.

Do loan providers consider your credit limit whenever obtaining a home financing?

When loan providers evaluate home loan software, it test your income, costs, and you may present financial obligation preparations. Even though you do not have high financial obligation on your own credit cards, they’re going to remain found in lenders’ computations.

According to Put aside Bank out of Australian continent investigation, Australian people hold normally 1.3 handmade cards, definition a lot of people have more than you to definitely. These may possess differing limits and balances however,, if or not they’ve been used or perhaps not, of many loan providers have a tendency to check out the collective restriction of one’s credit cards once they assess your house application for the loan.

This might come once the a shock to a few as many individuals guess loan providers are not as well worried about cards which might be moderately used or hold very little personal debt. But that’s hardly the case.

As opposed to the loans your credit cards bring, lenders tend to work at your own credit limit that they commonly identify once the established personal debt whether you’ve utilized it or otherwise not. Basically, regarding the attention many loan providers, you may be with the capacity of maxing out your handmade cards on anytime.

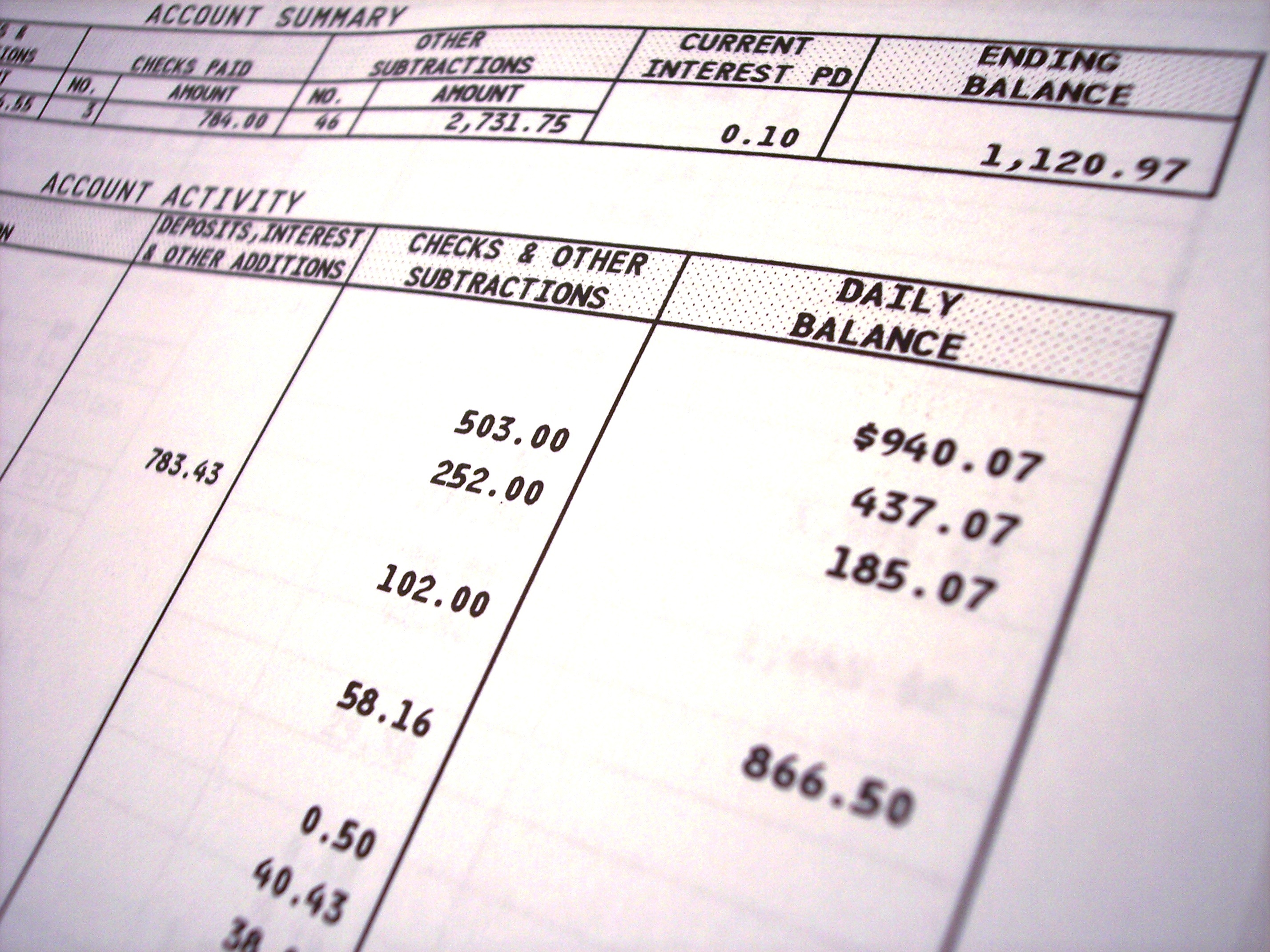

The wide variety works

Usually of thumb, a month-to-month charge card installment is generally from the dos-3% of the card’s closure harmony. Of many loan providers usually determine your regular mastercard repayments becoming 3% of your mastercard limit.

Such as, if you have a credit limit out-of $ten,000 around the several cards, loan providers normally guess the minimal monthly payment become doing $three hundred a month. They will implement so it if or not you have maxed out your maximum otherwise are obligated to pay absolutely nothing on the charge card levels after you fill in the job.

To give you certain tip, our borrowing power calculator can be color a picture of just how your credit cards can impact extent possible obtain.

You are going to that have multiple playing cards damage your home financing chance?

It is probably not surprising that one to that have several playing cards is sound alarm bells to own loan providers, causing them to suspect you will be traditions outside the mode.

Due to the fact we have mentioned before, your own financial can look at your mutual borrowing limit after you submit an application for a home loan. Consequently the more cards you’ve got, the better brand new monthly credit card repayments your own bank commonly imagine you’re paying.

When you’re having fun with several playing cards so you can manage your money, you could potentially think getting in touch with the organization to lessen the brand new constraints to the bare minimum.

Like that, you not only put a top into attraction to utilize their card getting things away from extremely important expenses, but you’ll as well as place oneself inside the a much better reputation to track down that loan when it comes time to try to get home financing.

Must i personal my credit cards before you apply getting a mortgage?

If you are searching purchasing a home at the top of their credit potential, it may pay to close the mastercard accounts so you can free right up most credit power.

But not, if you’re not planning score a loan getting as frequently as you are able to and you are responsibly utilizing your playing cards, it does in fact work against you to personal your own mastercard levels, just like the we are going to mention lower than.

However, if you are having your finances in order to make an application for an effective mortgage, it is best to obvious normally credit card debt as you reasonably normally and lower the newest constraints for each credit.

Overusing handmade cards plunges your credit score

It should forgo stating that if you’re making use of your borrowing notes willy-nilly and you will forgotten repayments, or you happen to be frequently exceeding your own credit limitations, your credit score could be using the struck. Needless to say, this will enchantment troubles once you submit an application for home financing.

Can your credit card need increase odds of delivering approved for home financing?

With your charge card can in fact change your credit rating, however, on condition that you will do it having caution. Investing in purchases together with your card and you can settling the bill on time demonstrates an optimistic fees trend in order to potential loan providers.

For those who have established credit card debt, make an effort to shell out more than minimal monthly payments on a daily basis. This may even be worth asking their bank card supplier in order to lower your limitation toward reduced part one to nevertheless match your demands.

Everything boils down to demonstrating you are in control. Lenders want to see to handle debt and you will carry out your finances really, so think about you to definitely prior to using your mastercard.

Whenever you are alarmed the credit card incorporate you can expect to hinder their hopes and dreams of buying a home, you could turn to a large financial company to possess personalised suggestions in order to aid in increasing their credit electricity. They may including help you find lenders that a lot more comfortable regarding charge card have fun with.

Credit card or not, every homeowners try seeking to support the lowest financial attract speed offered to them. When you are searching for home financing, check out of the greatest also provides nowadays at this time: