What exactly are Very first Responders?

Basic responders are those which respond to problems are priced between the latest following the procedures and you will loan providers who bring home loans getting earliest responders start from alot more that are not given below.

- Police

- Fireman

- EMTs

- Paramedics

When you’re a primary responder and do not see your field mentioned above, call us because you still can be qualified.

Mortgage brokers for Earliest Responders

There are earliest financing programs that is certainly well suited for basic responders. These are standard financing software however when included which includes away from the latest special bonuses which can be discussed lower than, it makes to acquire a property most affordable.

- Need certainly to meet the requirements playing with recorded money

- 5%+ advance payment requisite

- No PMI that have a downpayment of at least 20%

- Minimal credit score of 620 expected

FHA Ideal for whoever has down credit scores or who happen to be seeking to be eligible for a more impressive amount borrowed.

- Downpayment with a minimum of step 3.5%

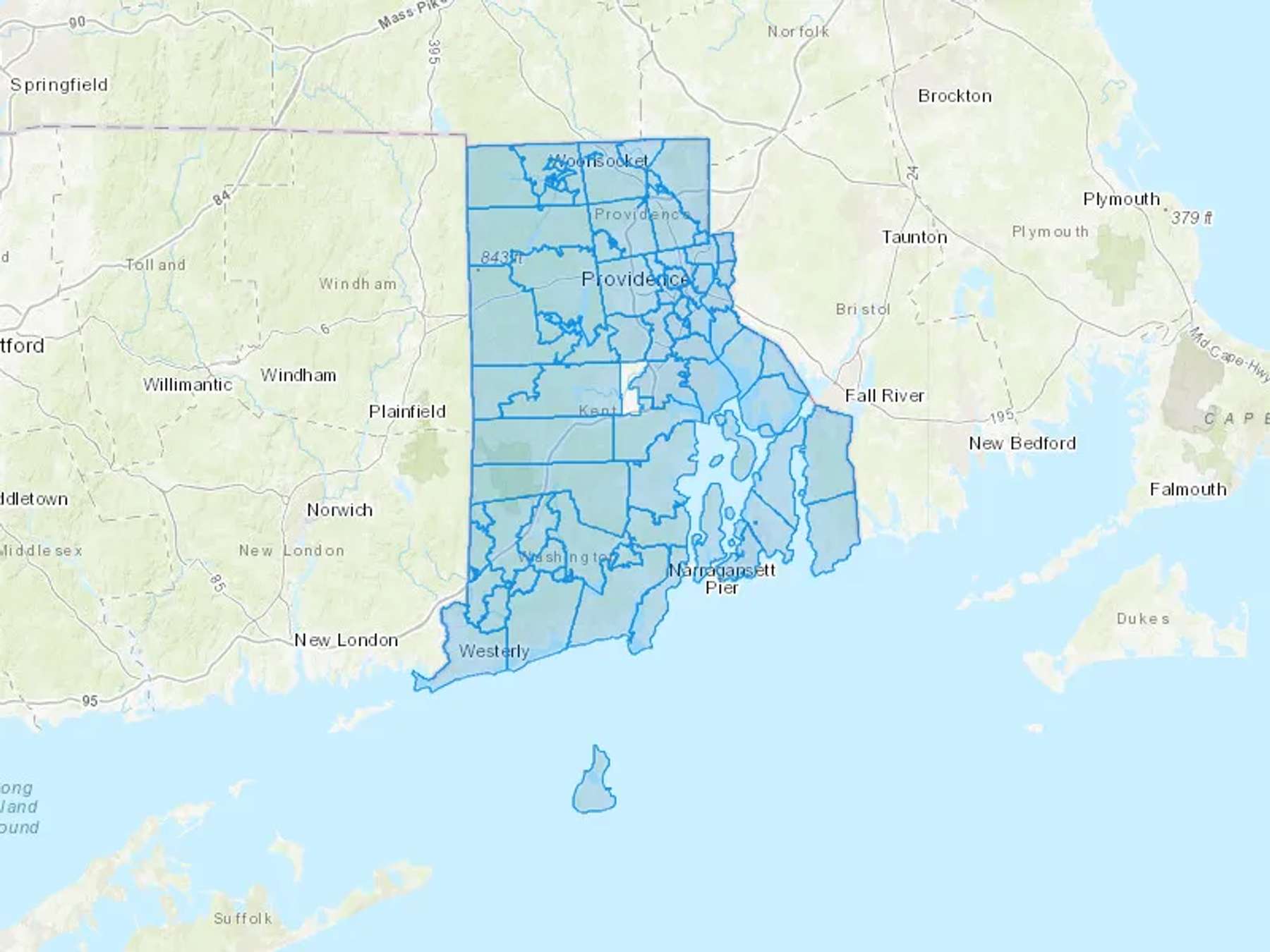

USDA When you find yourself to find during the an outlying urban area, a great USDA loan try a course that you may possibly qualify for with no advance payment.

Va If you are together with effective army or veterans, an excellent Virtual assistant loan with no down are financing program so you can believe.

These are just a number of the programs which can work to have earliest responders. Simply done this short loan circumstance function and some one will call to go over the options and the incentives to have very first responders.

Some lenders will give some family client incentive programs getting basic responders. The worth of these types of bonuses are extreme and will help to reduce your out of pocket will set you back. Such bonuses are supplied of the loan providers who will be seriously interested in enabling very first responders and may even tend to be several of all adopting the:

Keep in mind that your most likely try not to rating all the incentives more than meanwhile. Such, the financial institution get commit to defense your entire settlement costs nevertheless more than likely may not be during the reduced rate.

Home loan Costs to possess Basic Responders

The interest cost having first responders is competitive and can getting significantly influenced by your credit ratings. The bank may offer the opportunity to choose the rate off and those can cost you should be protected by the vendor.

Even when lenders dont give special mortgage prices getting very first responders, the latest bonuses available will help with your with your own money can cost you when purchasing a house.

Every offers which you find being offered so you’re able to first responders are of these that assist that have investment devices and knowledge to help you let first responders to-do their job (earliest responder has).

You may find household client offers in your neighborhood that may advice about downpayment and you may settlement costs. A few of these are not only getting basic responders, but you’ll need to be a first time home visitors.

Doctors Who possess a current Bankruptcy proceeding

Of many physicians provides struggled during tough times and you may felt like that a bankruptcy proceeding are a knowledgeable monetary choice. If you are a doctor, medical practitioner, otherwise physician and educated a current personal bankruptcy, you could nonetheless qualify for home financing.

Chapter 7 Personal bankruptcy When your bankruptcy is actually a section seven, you could be considered an individual big date immediately following your own launch for a good mortgage. Although not, it almost certainly will need a much larger advance payment.

Chapter thirteen Personal bankruptcy In case the personal bankruptcy are a part 13, you might be eligible for an enthusiastic FHA financing https://clickcashadvance.com/personal-loans-ga/ once you have produced simply 12 promptly personal bankruptcy repayments.

Very first responders do not get a savings towards the loan or loan harmony, but some loan providers make discounts available to your some of the financial charge and you will closing costs.

Just what Others assert Regarding Basic Responder Mortgages

Eric Jeanette First responders let our groups and frequently place by themselves at risk. They want to provides unique software to assist buy otherwise refinance good family.